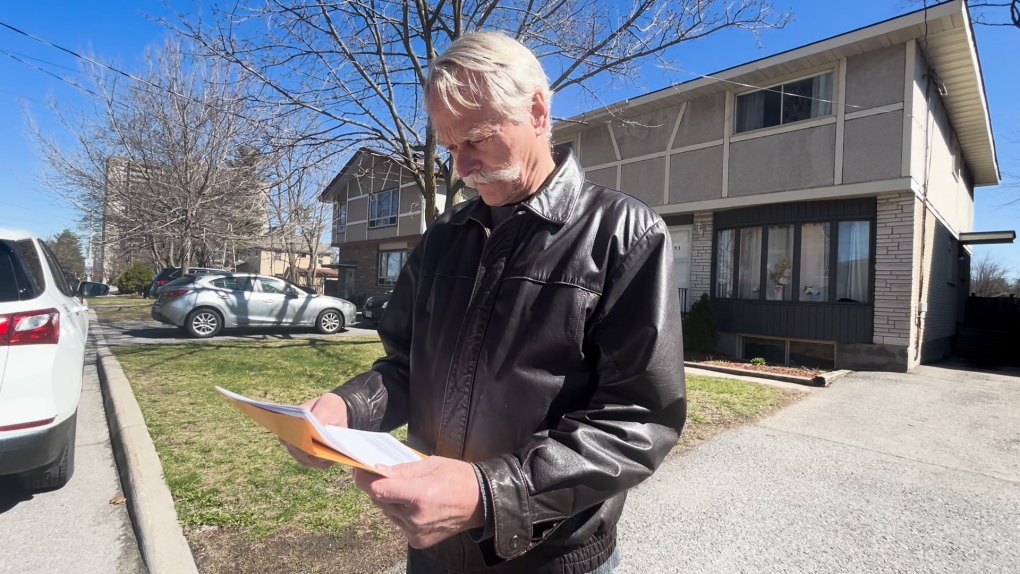

For years, Roland Reebs has been renting out a semi-detached home on Pinewood Crescent. It’s one of two properties he’s declared under the City of Ottawa’s Vacant Unit Tax (VUT).

A week ago, Reebs got a letter from the City saying he owed $2,700 from his 2023 declaration, due at the end of April. He argues the circumstances were beyond his control.

“I had a very bad tenant at the property and I was absolutely amazed at the damage that was in the house,” he said. He also said he dealt with squatters in the rental home.

From April 2022 to November 2022, the unit was sitting empty, as it underwent interior renovations.

Reebs tried to appeal the fine, but to no avail.

“The city identified the VUT and it indicated that if the property is empty for more than six months, then a VUT surtax has to be paid, which is 1 per cent of the municipally assessed value,” he said.

Reebs believes the city is in the wrong and will continue to appeal the fine.

“The city is preoccupied with generating as much revenue as it can instead of providing incentive for landlords… There’s no fairness,” he said.

The VUT is designed to crack down on livable homes that may be sitting empty for six months or more. Revenue raised from the tax is intended to go toward affordable housing initiatives.

It has been a contentious issue since it was introduced. According to the city, 3,363 properties have been charged the one per cent VUT levy for the 2023 cycle. The final numbers for the first VUT cycle will be published on the city’s website in the fall of this year.

“It’s a tax grab,” said Bob Paquette. His in-laws who live in an apartment in Orléans are on the hook for $250 in late fees. The homeowners filed their declaration a day after the deadline by phone. Paquette has been trying to fight the fines.

“They’re on a fixed income. This is like two weeks of groceries for these people,” he said. “Everybody is going through hard times, financially, right now. I just think a bit of compassion and common sense from the city is needed.”

In a statement, deputy treasurer Joseph Muhuni says this year’s Vacant Unit Tax declaration period opened in mid-December 2023 and residential property owners had until March 21 to complete the declaration or be charged a late fee.

“The City implemented a comprehensive communications campaign to ensure all eligible property owners fulfill their annual declaration obligation. These efforts included e-mail and letter notifications delivered in January, hard copy inserts with property tax bills, messaging on water bills, multiple email reminders, reminder letters, multiple automated phone call messaging, social media engagement, digital billboards, articles in community newspapers, public service announcements, bus advertisements, and posters displayed at City facilities.

“While the City cannot comment on specific cases, there is a process to waive the late declaration fee under certain circumstances, which is defined in the City’s Vacant Unit Tax by-law. Residents are encouraged to contact Revenue Services at (613) 580-2444 or email vut_ilv@ottawa.ca for further information.

“For the 2024 VUT cycle, a total of 325,000 properties (99.2 per cent) have filed their declaration. Properties that did not declare by the March deadline have until April 30, to declare or be charged the Vacant Unit Tax.”